Executive Briefing

Ozempic users are going crazy for deli meat, fries, and handbags

GLP-1s are life-changing drugs, transforming not only waistlines but also identity and indulgence.

Ozempic and other GLP-1 weight-loss drugs have not torpedoed the food and CPG industries the way some had feared. But they do drive meaningful shifts in users’ spending.

I recently watched a new, hourlong presentation from Circana about GLP-1 users’ changing grocery and retail shopping habits, based on its checkout-scanner and omnichannel shopping data (link to full slide deck).

Here are some of the highlights.

The number of Americans taking GLP-1 drugs continues to grow substantially. There’s no official tally, but Circana believes that 23% of US households — about 30 million — had at least one GLP-1 user in September, suggesting there are tens of millions of users. By 2030, five years from now, it expects GLP-1 households to purchase 35% of food sold in the US (measured by units), up from 24% today.

GLP-1 usage continues to shift toward weight loss and cosmetic/aesthetic/casual/microdosing usage, away from diabetes management. As usage has grown, 78% of GLP-1 users now cite weight loss as a motivating factor for using the drugs, up from 37% in 2021. Meanwhile, 43% cite diabetes as a motivating factor today, down from 75% in 2021. Almost half of users are now “weight only,” twice the proportion as two years ago.

Deli meats are a big winner as GLP-1 users shift their grocery spending toward products high in protein and fiber. Protein is a top food trend for many consumers, but especially for GLP-1 users, who need to preserve muscle mass while losing weight.

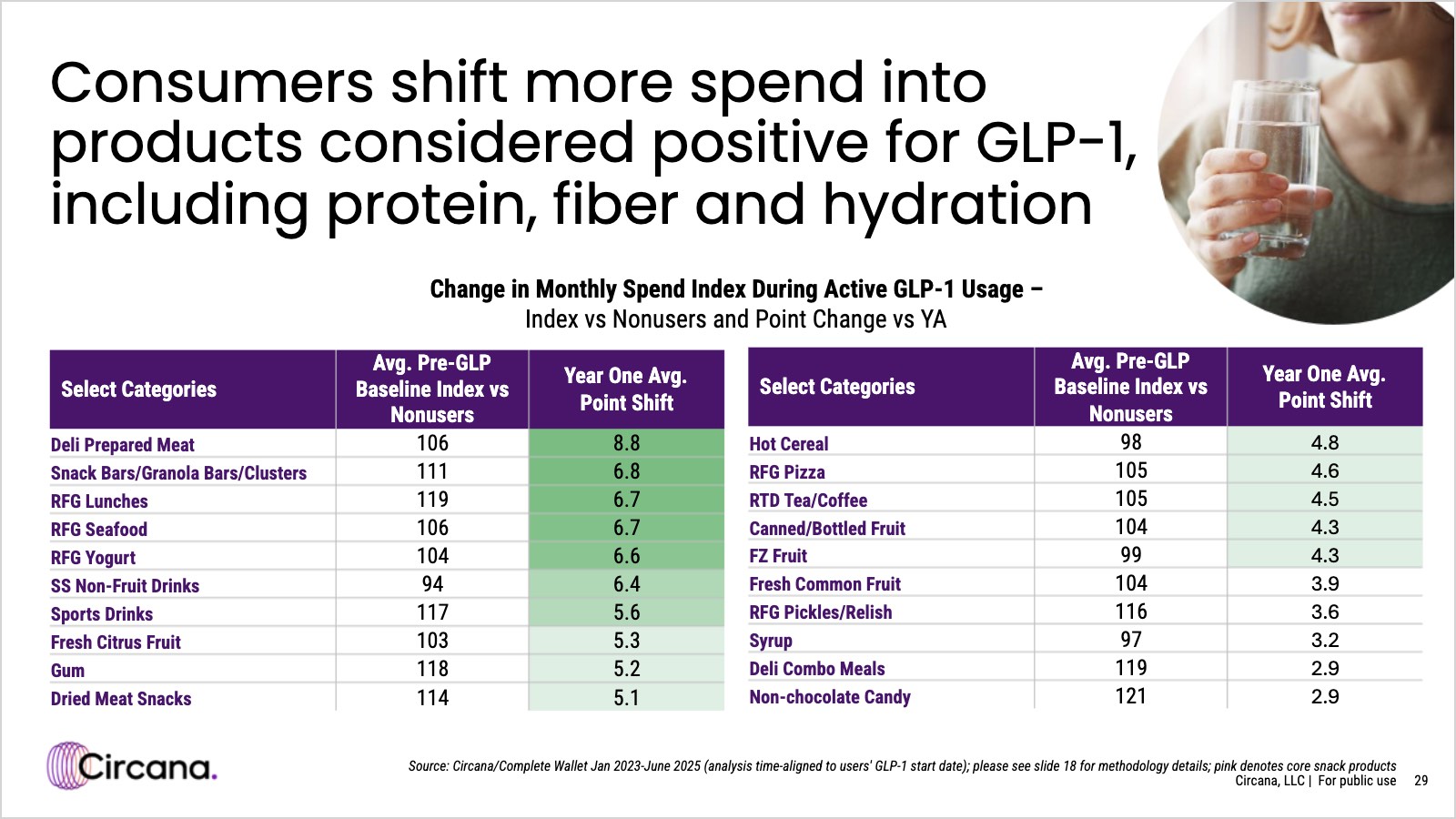

The top-gaining categories among active GLP-1 users, as tracked by Circana, include prepared deli meats; snack bars and granola; refrigerated lunches, seafood, and yogurt; beverages, including sports drinks; fresh citrus; gum; and dried meat snacks.

Here’s how to read the data on these slides, btw: The “average pre-GLP baseline index” shows how GLP-1 users’ spending compares to the average US household (100) before they started using the medication. So in the case of deli prepared meats, active GLP-1 users were at 106 to begin — roughly 6% bigger shoppers than the average household. Adding another 8.8 points in a year, then, as they did in the case of deli meat, is pretty significant.

Fries — the great equalizer. Balancing sensible foods with treats, weight-loss focused GLP-1 users over-index in eating protein-rich eggs for breakfast (20% of the time) and chicken for lunch.

But they way over-index in eating fries at lunch (12% of the time) and cookies at dinner.

The New Consumer Executive Briefing is exclusive to members — join now to unlock this 1,700-word post and the entire archive. Subscribers should sign in here to continue reading.

Hi, I’m Dan Frommer and this is The New Consumer, a publication about how and why people spend their time and money.

I’m a longtime tech and business journalist, and I’m excited to focus my attention on how technology continues to profoundly change how things are created, experienced, bought, and sold. The New Consumer is supported by your membership — join now to receive my reporting, analysis, and commentary directly in your inbox, via my member-exclusive newsletter. Thanks in advance.