Consumer Trends

Shopping never ends

Consumer spending is looking good heading into the holiday rush, and online grocery is growing again. The latest Consumer Trends Highlights.

Hello hello! It’s Dan Frommer. It’s The New Consumer. How are you?

I’ve just departed Austin, where, on Wednesday night, we hosted our inaugural WHAT’S WORKING event at The Malin in East Austin. It was great to see many of you there — thank you for joining!

I had the pleasure of interviewing Kin Euphorics founder Jen Batchelor and Made In co-founder Chip Malt — stay tuned for my notes in future newsletters — and then we opened the beautiful, brand new space for a housewarming party.

Of course, the big story since we last spoke is that Donald Trump won his second US presidency, aka the podcast election. This time, it was far less of a surprise: Most of my conversations in New York the week before the election concluded that his victory was likely and already mostly priced in. (The S&P 500 is up about 3% since last Tuesday’s close; Bitcoin, though, is up almost 30%.)

Will the Trump regime be more organized and effective this time? It’s obviously too early to say which of his proposed ideas that may affect The New Consumer universe — tariffs, tax schemes, merger friendliness, crypto friendliness, dramatic changes to government, etc. — will actually ever happen. But we’ll keep an eye on those as his inauguration approaches in January, and beyond.

Today, a new edition of Consumer Trends Highlights — the latest in my ongoing collaboration with Coefficient Capital. Here are some of my favorite data points, charts, and trends since our most recent report, which we launched in July. (We’re in the middle of our next big research cycle; stay tuned for Consumer Trends 2025 in December.)

Feel free to share this series widely — it’s free to read. If you’ve been forwarded this and want to receive our reports and updates, sign up for a free account at The New Consumer. Or for more analysis and benefits, including access to Office Hours, please become a member. Thanks again for your support!

Presented by Tiptop

Tiptop is a completely new, sustainable way to pay. It lets your customers trade in unused items to pay for new purchases. They’ll love finding money without having to sell. All while helping the planet by keeping old stuff in circulation.

Tiptop is currently offering $10,000 in promo credit that you can use to launch trade-in at checkout. Partners like Nothing, Drone Nerds, Backbone Daylight, Cradlewise, and King of Christmas love Tiptop.

If you’re a merchant, you can get started by visiting Tiptop now to sign up and learn more.

‘Very strong consumer demand’

Holiday shopping season is underway! And while Black Friday isn’t technically for a couple more weeks — late this year, on Nov. 29 — I’ve already been granted access to several Black Friday “deals.” You probably have, too. In the spirit of the Pumpkin Spice Latte, I guess we’ll just keep starting things earlier and earlier until it gets ridiculous and someone comes up with a better idea.

The good news: While the election was surely a distraction, US consumer spending continues to be strong. Overall spending growth outpaced expectations in September, for instance. And third-quarter earnings reports have looked solid, too.

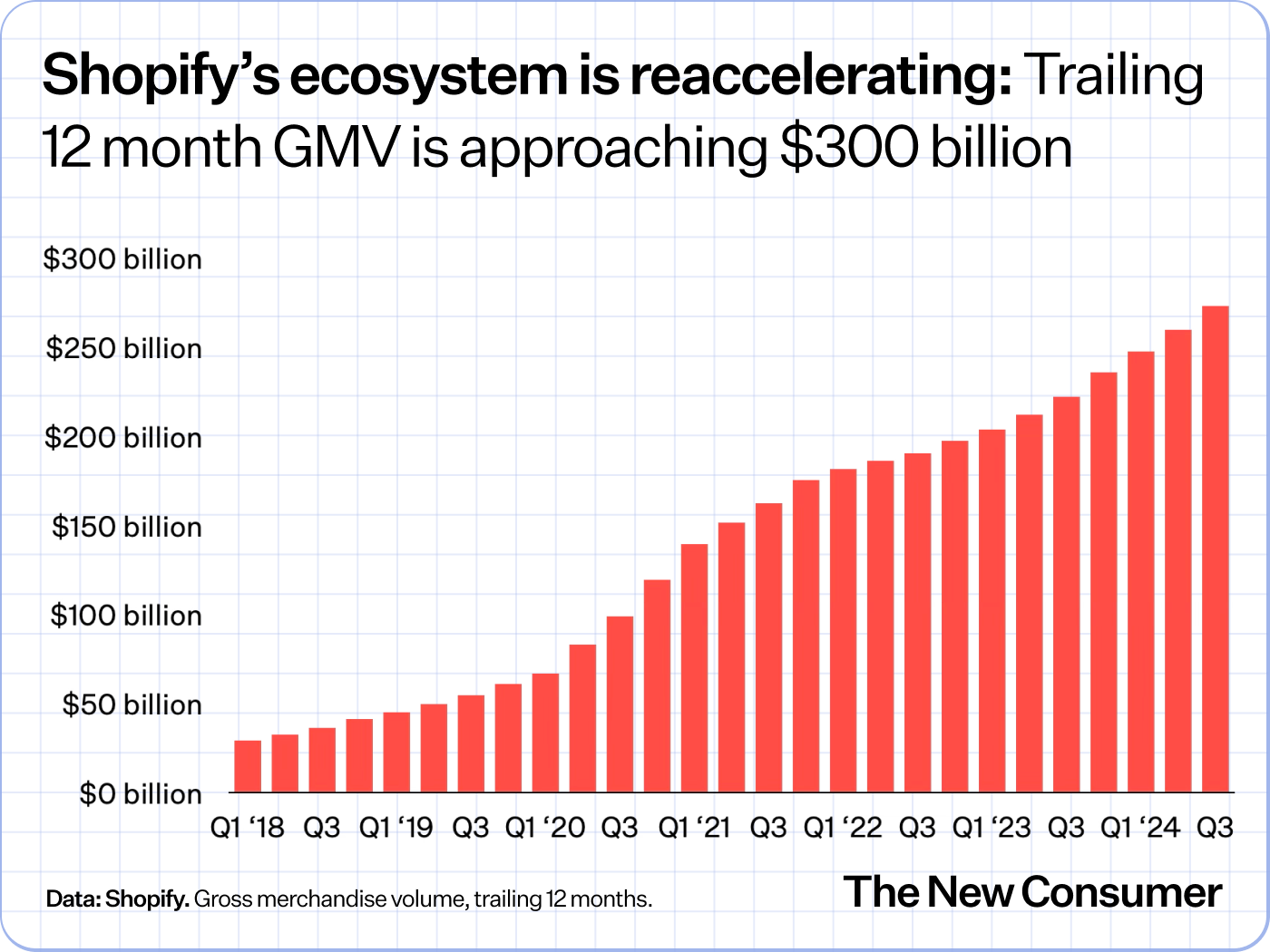

This week, Shopify reported that people spent almost $70 billion at the stores on its platform during the third quarter. That represents 24% year-over-year growth, and was almost $2 billion ahead of Wall Street’s expectations (per Jefferies).

It also shows continued acceleration: Shopify’s gross merchandise volume (GMV) hadn’t grown that rapidly in a quarter since the end of 2021. It has now grown almost 5x in 5 years, and more than 10x since the fall of 2017. Approaching $300 billion, it’s more than a third of the size of Amazon’s GMV, which TD Cowen estimates will reach $772 billion this year.

Instacart, the online grocery marketplace, also reported gross transaction value (GTV) growth ahead of expectations, up 11% year over year to $8.3 billion.

“We are seeing very strong consumer demand,” CEO Fidji Simo said on the company’s earnings call. Also important: “We haven’t seen meaningful trade-down,” she said, even across income groups and types of retailers.

At American Express, which reported results a few weeks ago, “the US consumer has been really stable,” CEO Stephen Squeri said on the company’s call. While spending growth isn’t as wild as it was during the pandemic stimulus era, “we feel good about the consumer,” he said.

Another positive note: Consumers haven’t gone on any particularly irresponsible credit-abusing tear. Amex’s percentage of past-due loans and receivables was 1.3% last quarter, in line with recent quarters, and still below the late-2019 pre-pandemic level of 1.5%.

Btw: Adobe, which tracks digital commerce, expects US holiday e-commerce spending to grow 8.4% this year to more than $240 billion, well outpacing inflation, and an acceleration over last year’s 4.9% growth. It’ll start publishing results in a couple of weeks, ahead of Cyber Weekend.

The chart that lost Kamala Harris the election

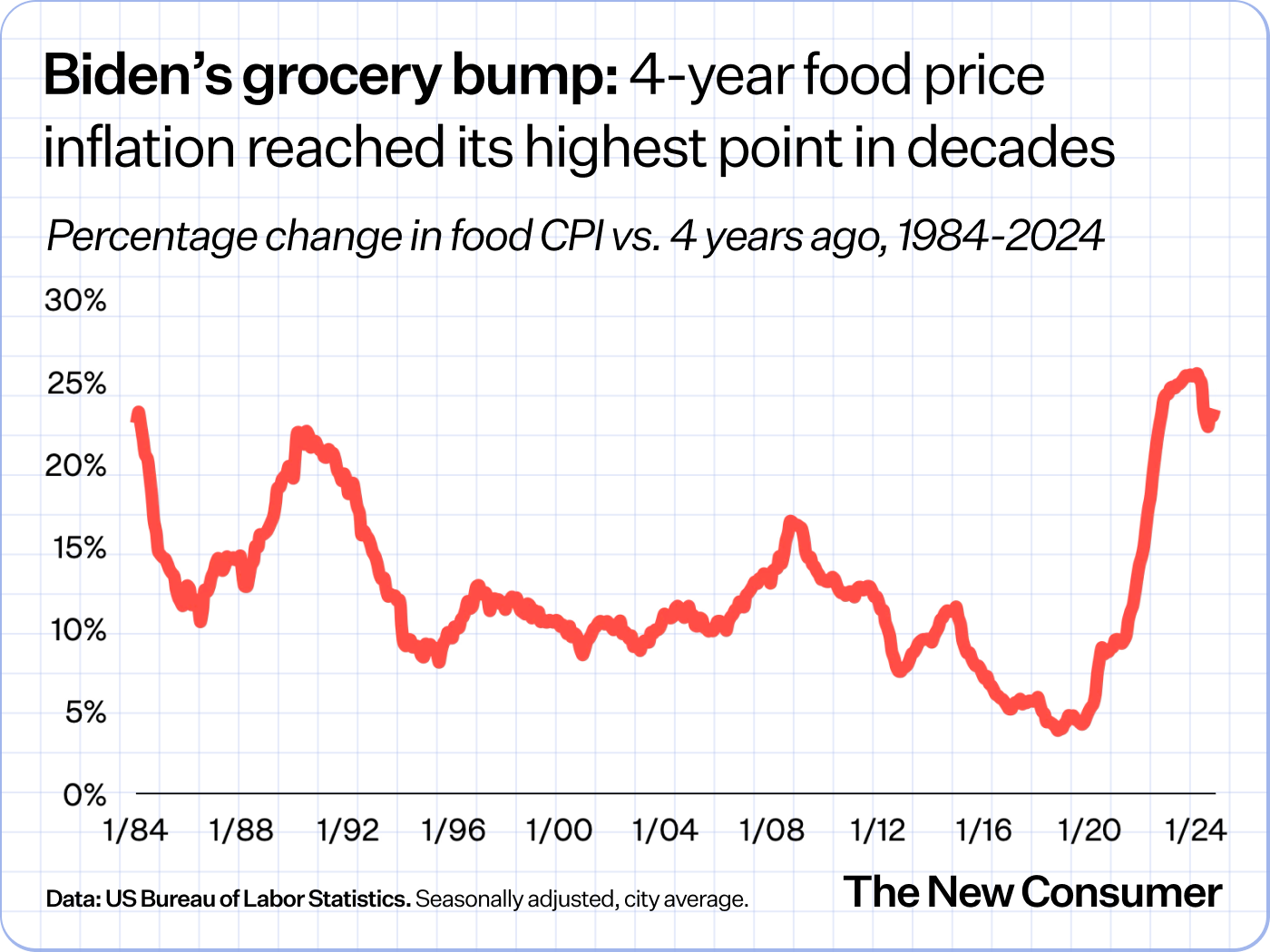

One of the more dramatic slides in our past few Consumer Trends reports has been this one, which shows how the Biden/Harris government has been able to bring COVID-era inflation back down from extreme highs while keeping unemployment relatively low and stable. Things could have been much worse!

On the other hand, while economists are pleased with decelerating inflation, consumers are still furious about high prices. Here’s a good FT article that unpacks a bunch of the nuance.

In addition to heightened economic inequality, prices — especially food prices — are still dramatically higher than they were 4 years ago, when Biden and Harris won the 2020 election. (Yes, wages are up, too. But good luck getting people to do that math.)

Heading into this election cycle, food prices had grown to around 25% higher than they’d been 4 years prior — a situation that Americans hadn’t really experienced since the early 1980s, when things were much worse (including 10% unemployment).

Here’s a 40-year chart showing the moving line of 4-year food inflation in the US — the length of a presidency term.

Fortunately, those prices are now falling slightly — grocery prices fell 0.1% year over year in October, per Adobe. So the curve is pointing down — though not nearly enough, nor fast enough, to change the incumbents’ narrative.

Online grocery is growing again

Online grocery shopping was a pandemic-era behavior that actually stuck. But then it stopped growing.

Now growth is back: US online grocery sales grew 14% year over year in Q3, and 28% in October, according to the latest Brick Meets Click/Mercatus survey. Most of the growth in Q3 was driven by online grocery delivery (as opposed to in-store pickup or ship-to-home orders), which generated 25% year-over-year sales growth, after a 6% decline the same time last year.

What’s driving delivery growth?

One thing that Instacart, the largest US online grocery marketplace, called out on its Q3 call is that it’s simply becoming more affordable.

Last quarter, its customers enjoyed an 18% increase in savings per order — now $5.35 — thanks to things like integrations with retailers’ loyalty programs, features that help reduce customers’ delivery fees, more flexible pricing tools for merchants, and brand promotions. (Instacart also ramped up its marketing spend. I’m not even sure if this includes the 10% rebates it was offering many Chase credit card users.)

In our Consumer Trends Survey earlier this year, most consumers said they still prefer buying groceries in-store. But a slightly higher portion of Gen. Z and Millennial consumers said they preferred buying groceries online.

Keys to unlocking future growth include the obvious — convenience, affordability — but also building online grocery shopping into more places and scenarios.

The good news is that e-commerce still represents a small portion of total US grocery spending — around 15% in Q3, per Brick Meets Click — so there’s still plenty of share to take.

Can Amex revive Tock?

Last month, American Express completed its $400 million acquisition of Tock, the restaurant ticketing and technology business, from Squarespace.

Tock, if you’re not familiar, offers a handful of services to consumers and restaurants, including prepaid bookings and table management software. It tends to serve the higher end of the market, including restaurants like Noma in Copenhagen, many wineries, and pop-ups.

During the pandemic, the narrative around Tock got a bit ahead of itself, including a Fast Company article declaring that it “saved the restaurant industry in the nick of time.”

It’s true that Tock moved fast, built useful tools, and shared a bunch of helpful industry data in a time of need and opportunity. (It was led at the time by co-founder and longtime CEO Nick Kokonas, who, until recently, also co-owned The Alinea Group, a group of high-end Chicago restaurants.) Squarespace acquired Tock soon after, in April 2021, for more than $400 million.

But the reality is that Tock never really became mainstream. And it definitely didn’t “save” the restaurant industry.

Tock is a real business, with around 7,000 restaurants, wineries, and other venues on its platform.

And unlike Resy (acquired by Amex in 2019) or OpenTable, it typically acts as a merchant to collect upfront deposits, which can be sizable — $625 per person to eat at Noma next year. The idea is that customers are more likely to show up for their reservations, on time, if they’ve already prepaid tens or hundreds of dollars. And restaurants are at least guaranteed the deposit’s worth of revenue, even if someone flakes.

This means estimated Tock spending is trackable via services like Earnest Analytics, which analyzes US consumer credit and debit card spending.

So how’s Tock doing?

According to Earnest’s data, US consumer spending on Tock peaked at the end of 2022 and has been shrinking since then. It’s not tanking, but spending on Tock in Q3 appears to have declined around 15% year over year, per Earnest. (For context, consumer spending in the broader restaurant category was roughly flat in Q3, according to Earnest.) More specifically, Tock’s transactions seem to be declining faster while average ticket grows.

It’s temping to read into this — is future interest in fine dining declining? — but we’d need more intel about the inner workings of Tock’s network to really know.

Anyway, can Amex get Tock growing again?

You could argue that with Resy and Tock under one roof, Amex is well-positioned to get its restaurant network using multiple complementary products. You might also argue that Tock’s relationships and inventory are much more valuable to Amex — whose wealthy cardmembers crave unique dining experiences — than they were to Squarespace, the web hosting and publishing tool. So perhaps it will be more intentional about operating Tock.

But we’ll see. Prepaid bookings add considerable friction, acquisitions are tough to integrate, and Tock’s founders are both gone. And while the hottest reservations will always command an audience willing to pay more — those Noma bookings are all sold out — in most places, the leverage still belongs to the consumer.

Also on my radar:

The New York food hall implosion continues: Gotham West Market in Midtown is the latest to close. While these seemed like fun, budget-friendly dining options after the financial crisis, they mostly feel dated these days, and evidently aren’t good businesses. Let’s see if Wonder, the 2.0 version led by Marc Lore — which also just acquired Grubhub — can do better.

Two big, highly funded, major-expectations consumer startups with are closing: Bowery Farming, the indoor-lettuce-farming company that raised $600+ million, and Forward, a membership-based doctor’s office that made a fuss about its technology and had raised ~$400 million. Each has different reasons for failure — you can read on Reddit about the pathogen that infected Bowery’s salad plants, and its high capex and lousy unit economics — but the bigger, more important picture is that huge zero-interest-era bets are being allowed to simply go out of business.

Amazon is launching its Temu clone, Haul. Can it work without Temu’s obnoxious gamification? Maybe.

ThisBowl, a semi-recent Aussie import in NYC, is the best new lunch spot I’ve tried in a long time, and Lane Florsheim went into details in the WSJ, including some quotes by yours truly. Another Stripes Group consumer joint — on a roll?

‘Microdosing Ozempic’ in the LA Times.

Why Waterloo made sparkling mocktails like All Day Rosé: “The one thing that is very consistent is this demand for multi-sensorial, fuller flavor sparkling water that brings unique flavor profiles to the category.”

The great Amanda Mull on the Martha Stewart Netflix doc, which I enjoyed: “After watching Martha, the new Netflix documentary charting the rise, fall and eventual redemption of Martha Stewart, it’s difficult not to walk away with the vague urge to do something—throw a party, bake a pie, arrange some flowers, check in on your enemies. That’s not the point of the film, which was released at the end of October, but Martha just has that effect on people.” (Gift link.)

The growing global appeal of the Japanese ryokan: Colin Nagy’s latest for Skift.

Obligatory mention whenever a great new clothing store opens: I loved my visit last month to Ven. Space in my old Brooklyn neighborhood, which got a nice write-up by Jacob Gallagher at the NYT. Major shoe problem, solved!

Presented by Tiptop

In an era of rough consumer sentiment and deep discounting, all retailers are looking for an edge. Tiptop provides that edge with a fresh, consumer friendly checkout option that isn’t just the most affordable way to pay, it’s also the most sustainable. Check it out now to learn more.

Hi, I’m Dan Frommer and this is The New Consumer, a publication about how and why people spend their time and money.

I’m a longtime tech and business journalist, and I’m excited to focus my attention on how technology continues to profoundly change how things are created, experienced, bought, and sold. The New Consumer is supported primarily by your membership — join now to receive my reporting, analysis, and commentary directly in your inbox, via my member-exclusive Executive Briefing. Thanks in advance.