Consumer Trends

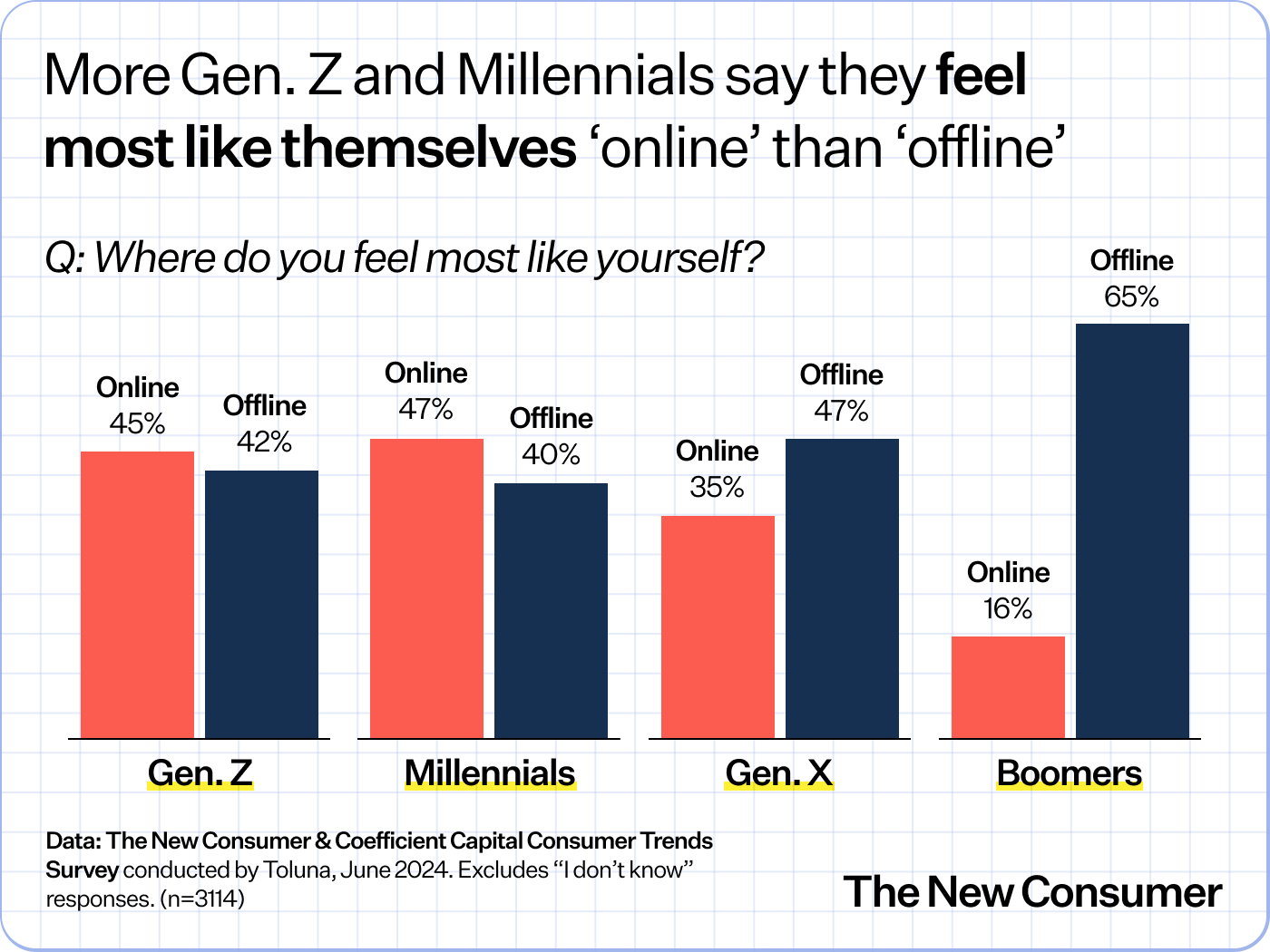

More Gen. Z and Millennials say they feel most like themselves ‘online’ than ‘offline’

Also: Even TikTok addicts don’t really trust China. The celebrity-backed booze bubble is deflating. And more Consumer Trends Highlights.

Hello hello! It’s Dan Frommer, back with The New Consumer. Only 106 shopping days left! (And welcome, new members — I’ll be topping you up with two extra weeks.)

I am home from a quick Chicago trip last week for the grand Foxtrot re-opening. Founders Mike LaVitola and Taylor Bloom are back with a small team to reboot the convenience store / café after a very dramatic year. The opening-day vibes were promising.

Today, a new edition of Consumer Trends Highlights — the latest in my ongoing collaboration with Coefficient Capital. Here are some of my favorite data points, charts, and trends since our most recent report, which we launched in July. (You should check that out, too, if you haven’t!)

Feel free to share this series widely — it’s free to read. If you’ve been forwarded this and want to receive our reports and updates, sign up for a free account at The New Consumer. Or for more analysis and benefits, including access to Office Hours, become a member. Thanks again for your support!

More Gen. Z and Millennials still ‘feel most like themselves’ on the internet

One of my all-time favorite survey queries showing differences between younger and older generations of Americans: More Gen. Z and Millennial consumers say they “feel most like themselves” online, rather than offline. It’s the opposite for Gen. X and older generations.

This has been one of the most popular insights from our Consumer Trends Surveys since we started conducting them four years ago, polling thousands of US consumers in partnership with Toluna.

This helps explain how digital culture has come to dominate culture. And why, for instance, Kamala Harris’s presidential campaign immediately adopted a very “online” tone of voice, to quickly activate and energize young voters.

(Younger consumers are also more likely to say they feel “more valued for their talents” online than offline, feel “more appreciated” online, and feel “more creative” online, than older consumers.)

But when we last published those stats in mid-2022, we were still coming out of a massive global pandemic that disrupted many aspects of our lives, from where and how we worked to how we entertained ourselves.

This past summer, we wondered: Were those responses the direct result of Gen. Z and Millennial consumers being digital natives who mostly grew up online? Or were they temporarily heightened because of the pandemic lockdown effect?

So we thought it would be a good idea to pose that question again in our most recent Consumer Trends Survey, now that we’ve returned to as much of a new post-COVID “normal” as we may ever.

The answers from this June turned out to be consistent with the last time we polled in 2022: When asked to select “Where do you feel most like yourself?” more Gen. Z and Millennial consumers again chose “online” than “offline” — though it’s still pretty close. And the clear majority of all older consumers again chose “offline.”

The biggest shift among generations was for Boomers: 16% now say they feel most like themselves online, up from 10% in 2022. “Online” also picked up around five percentage points for Gen. X. Meanwhile, “offline” grew a tiny bit among younger consumers.

Still, pretty close — suggesting this is just how it is.

Even TikTok addicts don’t really trust China

TikTok continues to have the unique distinction as one of the fastest-growing commerce engines in the US, one of its most popular media platforms, and something the government is attempting to ban if its Chinese owners don’t divest it.

If we’re being honest, the real concern about TikTok is that China’s government might be using the video service — which many millions of Americans, especially younger ones, watch for a long time every day — to further its agenda, pushing content that makes people here feel and act more socially and politically divided.

So we posed some questions to our Consumer Trends Survey panel in June — specifically, to the ~80% of Americans who say they are aware of TikTok.

Almost 40% of those say yes, they think the Chinese government is using TikTok’s content recommendation algorithm to make Americans feel more socially and politically divided. Another ~30% say no, and roughly another third say they’re not sure.

“Yes” responses are slightly lower among younger consumers, higher among older generations, higher among men than women, and higher among people who don’t use TikTok than those who do. Gen. Z, which is most closely associated with TikTok, has the highest portion of “no” responses at 46%.

Still, fewer than half of daily TikTok users — those who use the service most — say “no,” they don’t think the Chinese government is using the algorithm to mess with Americans.

Of course, a smaller portion says they’re concerned that TikTok’s Chinese ownership may influence their opinions or perspectives. Only 26% of those aware of TikTok say they’re “extremely” or “very” concerned; 20% are “somewhat” concerned, and 54% are “not very” or “not at all” concerned. These responses are pretty consistent across different demographics and TikTok usage frequencies.

Q: Do you think the Chinese government is using TikTok’s content recommendation algorithm to make Americans feel more socially and politically divided?

- Overall: Yes 39%, No 29%, Not sure 32%

- Gen. Z: Yes 34%, No 46%, Not sure 20%

- Millennials: Yes 36%, No 37%, Not sure 27%

- Boomers+: Yes 48%, No 10%, Not sure 42%

- TikTok daily users (self-identified): Yes 31%, No 46%, Not sure 22%

- TikTok non-users: Yes 48%, No 11%, Not sure 41%

- Men: Yes 48%, No 28%, Not sure 25%

- Women: Yes 33%, No 29%, Not sure 38%

Data: The New Consumer & Coefficient Capital Consumer Trends Survey, June 2024. (n=2760) Among those aware of TikTok. US only, 15+.

What do Americans think of China, anyway?

As part of our most recent survey in June, we asked our panel — nearly 3,500 US consumers, intended to be a representative sample of the population — to rate their overall impressions of 10 nations: The US, Canada, Mexico, Sweden, Iran, China, Russia, Israel, Japan, and France. “Consider each country relative to all other nations globally,” we instructed, “and consider all aspects of life in that nation (social, economic, etc.).”

- The US scored the highest: 77% of Americans said they have a “very” or “somewhat” favorable impression of the country. It’s higher among men (82%) than women (74%), and higher among Boomers+ (90%) than Gen. Z (62%).

- Canada scored second-highest: 64% of US consumers have a “very” or “somewhat” favorable impression. For Mexico, it’s 31%, higher among Gen. Z (36%) than Boomers+ (26%).

- Russia had the highest “very unfavorable” percentage at 45%, followed by Iran (40%) and China (33%).

- Just 14% of Americans had a favorable rating for China, but it was much higher among younger generations (24% for both Gen. Z and Millennials) than older (3% of Boomers+).

- Some 35% of Americans had a favorable rating for Israel, higher among older generations (49% of Boomers+) than younger (22% for Gen. Z). A similar portion of Gen. Z consumers selected a favorable rating for China (24%) as for Israel (22%).

The celebrity booze bubble has deflated

In the spirits industry, brands with a celebrity attached to them as a founder or ambassador still “do tend to outperform the overall market,” says research firm IWSR. But as the cycle turns and the numbers get bigger, growth rates for celebrity brands have slowed.

In the tequila market, for instance, celebrity brands grew global sales volume 16% last year, outperforming the broader category, which grew just 3%. But that was a big deceleration from 2022, when celebrity tequila brands grew 40%.

Our past Consumer Trends research has shown that young, urban, and wealthy consumers are particularly drawn to celebrity-backed brands. Celebrities come with built-in audiences — crucial in this era of high customer acquisition costs — and trust attached. But it’s not magic. And the product still has to be really good to make it over the long run.

A real appetite for ‘food as medicine’ budgets

Should health insurance companies reimburse people for eating better? Our diets, after all, are causing a huge amount of heart disease, diabetes, and other expensive medical problems.

In our Consumer Trends Survey, almost two-thirds of US consumers — and almost three-fourths of Gen. Z and Millennials — said yes, if costs were the same, they would pick a health insurance plan that offers them a healthy meal stipend or provides a monthly supply of their favorite “better-for-you” foods. Some 15% of consumers said no, and another 19% said they didn’t know.

Also, more than half of consumers — and 70% of Gen. Z and Millennials — said they would pay more for a health insurance plan if it included those benefits. About 19% said they would pay “a lot more” and 34% said they would pay “a little more.” Around 34% said no, and 13% said they didn’t know.

Target’s view of the consumer

Target sits at the aspirational end of US mass retail, so its view of the consumer is useful regardless of economic conditions. It doesn’t always get things perfect, but its second quarter comparable-store sales grew 2% year over year — beating expectations — thanks entirely to 3% traffic growth, not inflation or price hikes.

Here are some highlights from Target’s Q2 earnings call last month, quoting executives:

- Consumers continue to focus on value, and are responding to price reductions: “Over the summer, we reduced our prices on about 5,000 frequently purchased items in many markets, and we saw an acceleration in both our unit and dollar sales trends in these businesses.”

- Beauty continues to gain meaningful share with comparable sales growth in the high single digits, “driven by a balanced combination of new offerings, celebrity brands, and seasonal relevance.”

- Target increased investment in hair care products, including launches with Jennifer Aniston and Blake Lively, whose exclusive-to-Target line, Blake Brown Haircare, “quickly became our biggest hair care launch on record. On launch day alone, Blake Brown had the five best-selling hair care items at Target.”

- It’s been a “summer of sun care, with guests looking for familiar, affordable options … as well as newer trending brands such as Vacation.”

- Smaller form factors — minis — also drove growth, “with travel on the rise and consumers looking for a little bit of affordable indulgence for at-home, too.”

- In food, comparable sales growth in the low single digits “was led by seasonal moments, with hundreds of new items across snacking, grilling and entertaining.” It also had a hit exclusive seasonal stunt product, Bubly’s Melted Ice Pop sparkling water, “which quickly grew to be the highest selling item in its category.”

- The company also “pushed ourselves to rethink assortment strategies that have been tried and true for years.” For example, it gave candy aisles a healthier makeover, “including lower sugar treats and wellness candies.” The result: “While this category was already growing, these changes raised the bar, accelerating comp growth into the double digits.”

- Health drove growth in its essentials category, “where protein drinks, powders and meal supplements are gaining momentum.” Relevant data point from our Consumer Trends research: A quarter of Americans think they aren’t getting enough protein in their diets.

We’re about to kick off research for our next big Consumer Trends report, due in December. Please get in touch if there’s a topic or question you’d like us to consider: dan@newconsumer.com.

Hi, I’m Dan Frommer and this is The New Consumer, a publication about how and why people spend their time and money.

I’m a longtime tech and business journalist, and I’m excited to focus my attention on how technology continues to profoundly change how things are created, experienced, bought, and sold. The New Consumer is supported primarily by your membership — join now to receive my reporting, analysis, and commentary directly in your inbox, via my member-exclusive Executive Briefing. Thanks in advance.